Caught in the crossfire of Donald Trump’s trade wars, Harley-Davidson has seen costs rising and been at the receiving end of presidential criticism for plans to move production to avoid those costs.

Meanwhile, it’s facing declining sales in its vital US market with an ageing buying demographic and now 2019 has started with a financial report showing disappointing earnings in the fourth quarter of last year and forecasting another sales drop this year.

Harley is responding by bodly expanding into new fields, a push which is being led by Matt Levatich, the 53-year-old who has been CEO since 2015 and with H-D for over 15 years. He is typical of a younger generation of executives at the Milwaukee-based company.

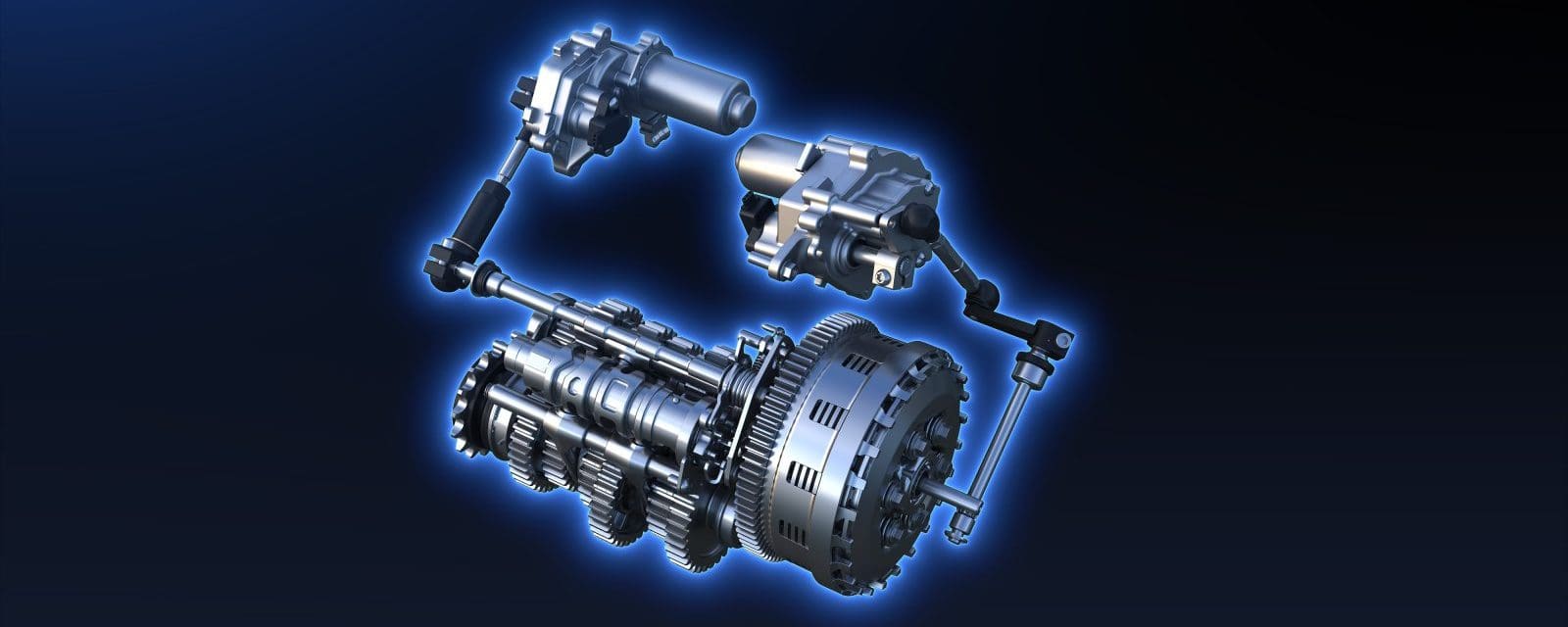

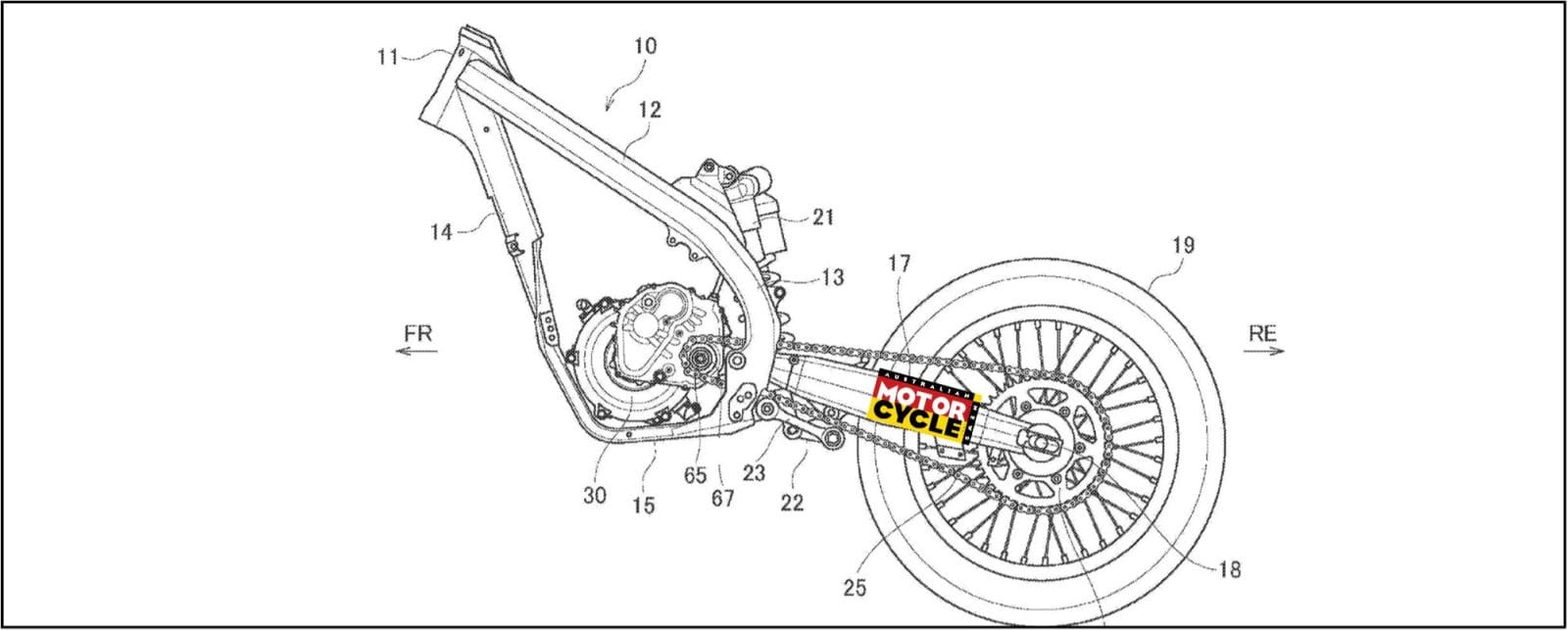

This year sees the electric LiveWire reaching production – albeit at a high price – and next year we’ll get Harley’s Pan America adventure bike. And Harley’s bold plans include 16 new water-cooled V-twins ranging from 500cc to 1250cc, including streetfighters, adventure bikes and customs. It’s even hinted at a fully-faired sportsbike, and wants to introduce a sub-500cc machine for Indian and Asian markets. And add the two new electric bike concepts unveiled a few weeks ago.

The future looks positive but Harley’s more immediate problems are having a direct impact on its current share price. These include a tough 25 per cent additional import tariff in Europe, a response to Trump’s similarly-sized import duty on European steel. In total, the H-D’s fourth-quarter finances were hit by some $13 million in tariffs, plus $23 million in restructuring costs. This year it’s expecting these additional tariffs – both on its exports and on materials it imports to manufacture bikes – to account for as much as $120 million.

On the plus side, Harley’s Thai manufacturing plant opened last year, and by the end of 2019 should make most of the models destined for the European, Chinese and Asian markets. That will drastically reduce the impact of those tariffs.

H-D’s challenge will be to balance its overseas production while retaining all-American models for its traditional and high-end buyers who don’t mind paying a premium.

Australian sales

Harley-Davidson tied on roadbike sales with Honda in Australia last year.

In a motorcycle market that contracted 8.7 percent, H-D’s sales fell 21.2 percent against Honda’s nine percent in roadbike sales. H-D’s Street 500 model was fourth in this class despite dropping 20.1 percent. Just behind was H-D’s Breakout, which experienced a 291.1 percent sales increase (it was only released in late 2017). These two models also led the Cruiser segment, with other H-D models coming in seventh to 10th. H-D also led the Touring segment, followed by another six of its models in the top 10. In overall sales figures, H-D came in seventh, just behind KTM. H-D’s total sales of 7019 were more than BMW (2922) and Triumph (2122) combined.

Worldwide battle of the brands

Harley-Davidson

In 2018, Harley’s worldwide sales dropped 6.1 percent to 228,051 motorcycles. It’s forecasting an additional decline of up to five percent in 2019 with projected sales of between 217,000 and 222,000. Its share price dropped seven percent in response to the announcement of its fourth-quarter 2018 earnings.

Triumph

The British manufacturer’s latest available figures are sales of 61,505 (for the period June 2017 to June 2018), down from 63,404 the previous year. It’s Triumph’s first sales drop in eight years, but profits were still high (second best ever at £9 million).

BMW

The German powerhouse experienced its best ever worldwide sales for the 2018 calendar year with 165,566 bikes delivered between January and December, up 0.9 percent on 2017. BMW has set new sales records for eight consecutive years now.

By Ben Purvis and Hamish Cooper