This time last year, Australia’s motorcycle retail industry was breathing a sigh of relief as sales figures managed to stay above 100,000 units for the previous 12-month period.

This time around sales have plunged through the magic 100,000 level to 95,080.

Latest figures released by the Federal Chamber of Automotive Industries make grim reading with the 2018 sales drop of 8.7 per cent following a 9.3 per cent plunge in 2017.

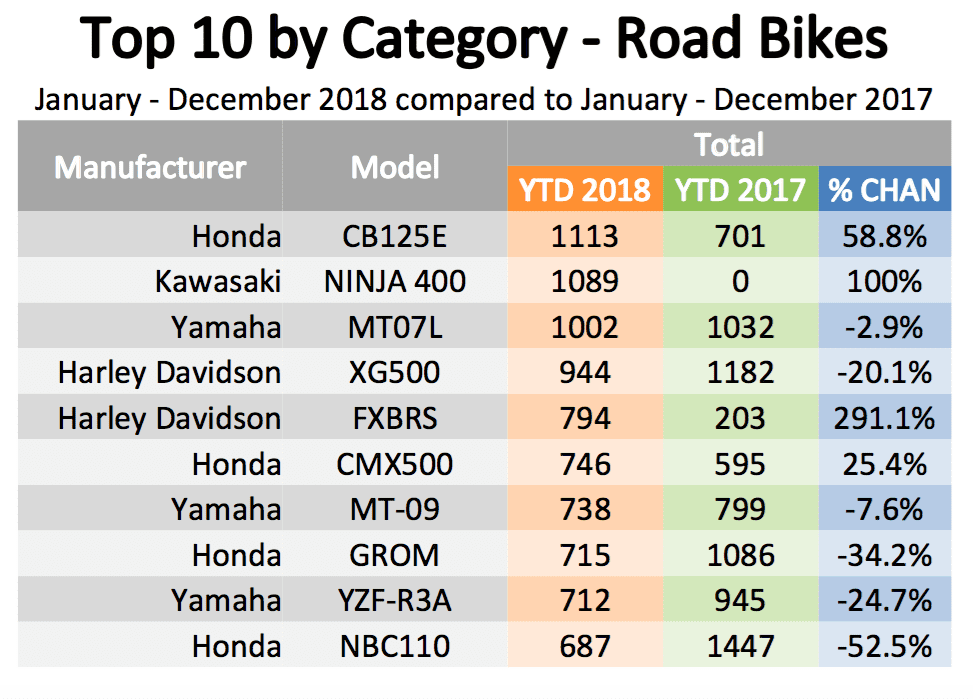

An indication of the gravity of the situation is Honda and Harley-Davidson tying on overall roadbike sales in a segment that has dropped 9.6 percent. Honda’s roadbike sales have eased nine percent while H-D has dived 21.2 percent.

Looking at major individual brands across the market, Honda led with 22,735 sales overall. Yamaha was second with 21,145, Kawasaki third (9376), followed by Suzuki (7557) and KTM (7497).

A closer look reveals how smaller-capacity motorcycles are becoming an industry staple. Honda’s CB125E (1113) leads roadbike sales, closely followed by Kawasaki’s Ninja 400 (1089). H-D’s Street 500 (944) leads cruiser sales and Yamaha’s YZF-R3, rather oddly, heads the sport touring segment. The supersport segment tells the same tale, with the biggest-selling large-capacity roadburner, BMW’s S1000RR (just 283), lying fourth and challenged by KTM’s RC390 (254).

These smaller-capacity motorcycles are driving a sales boom in Asia, India and China as locals graduate from cheap local products to affordable models from the world’s prestige companies.

Australian buyers are also being attracted to less expensive motorcycles that now feature much of the technology of their larger stablemates.

In the off-road segment, which fell 6.8 percent, Yamaha (11055) was the highest seller. Then came by Honda (9807) and KTM (5900), the only brand to increase off-road sales.

The ATV/SSV segment contracted from 21.8 percent in 2017 to 20.6 percent in 2018 while the previously shrinking scooter segment actually increased by a significant 12.4 percent.

By HAMISH COOPER

So what does the future hold in 2019?

Firstly, the overall market may not be as dire as these figures indicate. Well over a dozen brands aren’t represented in these sales figures. They include Royal Enfield, Benelli, MV Agusta, VMoto and SWM, all of which offer small-capacity models at chump-change prices.

Also, late 2018 saw the start of a raft of new models coming from the major manufacturers, putting a ray of light into local showrooms.

Meanwhile, with riders keeping their motorcycles longer, many dealers are surviving on workshop trade and selling products that enhance and upgrade current models.

Top selling roadbikes of 2018

Bike 2018 2017 change

Honda CB125E 1113 701 58.8%

Suzuki DR650 574 488 17.6%

Kawasaki Ninja 400 1089 0 100%

Honda Africa Twin 573 753 -23.9%

Yamaha MT-07 1002 1032 -2.9%

BMW R 1200 GSA 374 307 21.8%

H-D Street 500 944 182 -20.1%

BMW R 1200 GS 344 472 -27.1%

H-D Breakout 794 203 291.1%

Kawasaki KLR650 257 303 -15.2%

Honda Rebel 746 595 25.4%

Honda CB500X 248 274 -9.5%

Yamaha MT-09 738 799 -7.6%

BMW G 310 GS 224 48 366.7%

Honda GROM 715 1086 -34.2%

Suzuki DL650 216 189 14.3%

Yamaha YZF-R3A 712 945 -24.7%

Triumph Tiger 800 XC 182 167 9.0%

Honda NBC110 687 1447 -52.5%